RICS and Tughans Northern Ireland Construction & Infrastructure Market Survey, Q3, 2018

Overall Northern Ireland construction workloads edged upwards in the third quarter of the year, despite a marked decline in infrastructure and public sector work, according to the latest RICS (Royal Institution of Chartered Surveyors) and Tughans Construction and Infrastructure Market Survey.

Infrastructure workloads and public non-housing workloads were both reported to have fallen by a significant proportion of respondents, with many citing the lack of decision-making in government as a key factor in the decline.

Private industrial activity also saw a fall in activity, according to a net balance of -11% of surveyors.

However, the overall workload balance was pushed into positive territory by rises in activity in the private commercial sector and in private housing.

A net balance of +41% of respondents said that private housing activity increased in the quarter, while a net balance of +21% of respondents said that private commercial workloads rose.

Surveyors in Northern Ireland also continue to report shortages in quantity surveyors, other construction professionals, and blue-collar workers – most likely linked to growth in house-building activity.

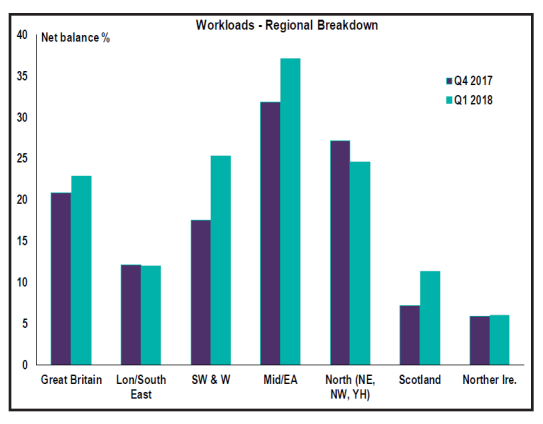

Looking ahead, Northern Ireland respondents are the least optimistic in the UK about the next 12 months when it comes to both workloads and employment.

Jim Sammon, RICS Northern Ireland Construction spokesman, said: “While it is encouraging that we are seeing rises in the private housing, private commercial sector and public housing subsectors, the picture across other areas, particularly infrastructure, continues to cause concern.

“The fact that infrastructure and public housing workloads are in decline gives an indication of the impact the lack of decision-making in government is having on the ground.

“It is perhaps unsurprising that surveyors here feel a lack of optimism around workloads compared with the rest of the UK. In addition to being worried about the pipeline of public infrastructure work, the confidence of local surveyors is being impacted by the ongoing noise around Brexit.”

Michael McCord, Partner, Tughans, said: “In some respects it appears that there is a two-tier construction market at present, with some private sector activity forging ahead, while surveyors report declines in infrastructure and other publicly-funded activity”.

“When we look at the cranes in the skyline around Belfast city centre and the number of houses being built across Northern Ireland it’s not hard to understand the rises in private commercial activity and housebuilding in the last quarter.

“The infrastructure picture is much less optimistic though, and this is backed up by latest official construction output statistics by NISRA which point to public spending on new projects falling further, effectively meaning that new infrastructure work has flatlined.”

The key headline Northern Ireland findings of the latest survey are as follows:

- The headline workloads net balance was 9% in Q3 (meaning that 9% more respondents reported rises in workloads than reported falls). This was significantly lower than the UK average of 20% and among the lowest in the UK regions.

- Public housing workloads rose according to a net balance of 12% of Northern Ireland surveyors

- A net balance of 41% of respondents reported rises in private housing workloads

- Meanwhile private commercial activity increased according to a net balance of 21% of respondents

- Private industrial activity was reported to have fallen (a net balance of -11%) recorded.

- Looking ahead, Northern Ireland surveyors are the least optimistic in the UK about the next 12 months when it comes to employment with a balance of (+13%) saying they expected to take on new staff, compared with a UK average net balance of (+25%)

- Expectations around workloads also are among the lowest in the UK, showing a balance of +17% compared with an average of 33% across the rest of the UK.

- The balance of surveyors saying that they expected to see profits in the next 12 months was only just in positive territory at +4%, but this was still higher than that recorded in the rest of the UK at -3%.

- Despite the lack of optimism in taking on new staff there was still marked increases in the balances of surveyors who said that they were seeing shortages in quantity surveyors (+57%), other construction professionals (+42%) and blue-collar workers (+49%).