RICS & Tughans Northern Ireland Construction & Infrastructure Market Survey, Q1 2018

Private industrial workloads saw growth for the first time in two years according to the Q1 2018 RICS (Royal Institution of Chartered Surveyors) and Tughans Northern Ireland Construction & Infrastructure Market Survey.

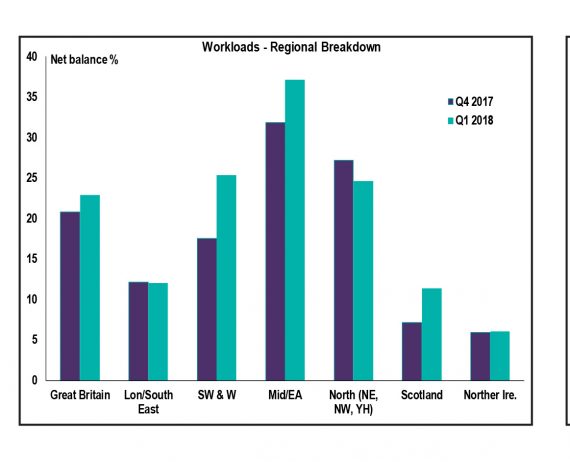

The survey also recorded a rise in the number of respondents saying that housebuilding had increased, with overall construction workloads therefore continuing to edge upwards although at the weakest rate in the UK (a workload net balance of +6%).

Meanwhile, growth in the private commercial sector saw a small rise in the three-month period, according to the net balance of Northern Ireland respondents.

But in the public sector it was a different story with lower levels of activity recorded in these subsectors. Public non-housing respondents have not reported growth for over one year while the net balance fell in the public housing sector. The infrastructure sector also saw a fall in workloads, according to the survey.

Looking ahead, Northern Ireland surveyors remain the least optimistic in the UK. Whilst the net balance of respondents expects workloads and employment to increase in the next 12 months, the net balances are the lowest of all UK regions. Northern Ireland is also the only region of the UK where the net balance of respondents expect profit margins to be lower in a year.

Jim Sammon, RICS Northern Ireland Construction Spokesman, says: “It is encouraging that housebuilding is continuing to grow in Northern Ireland and that the private industrial sector is at last showing some improvement.

“An increase in occupier demand for commercial property as shown in the most recent RICS Commercial Market Survey could be one of the reasons behind this growth in construction activity in the private industrial sector.

“Our respondents are continuing to point to the political situation as an impediment to growing construction workloads and we really need some progress on the political front to improve both confidence levels and investment.”

Michael McCord, Head of Construction, Tughans Solicitors, said: “It’s good news to see a further upturn in house building workloads and in private commercial and private industrial property.

“It’s disappointing to see a fall in infrastructure workloads but as much of this work is publicly funded it’s perhaps not surprising we are in this situation while we have no functioning Executive to push forward key infrastructure projects.

“The most recent NISRA figures, which show a slump of 5.5% in infrastructure output in the last quarter of 2017, also point to the decline in spending on private infrastructure and while they show that public infrastructure activity rose it remains at a lower level compared to recent years.

“When we look around the city it is encouraging to see building projects underway, mainly of a private commercial nature, but much remains to be done to move major and much needed infrastructure projects along.”

The key headline Northern Ireland findings of the latest survey are as follows:

- The headline workloads balance remained at 6% in Q1 indicating that workloads were flat for the fourth quarter in a row. This was significantly below the UK average (+23%) and below all other UK regions.

- Rises of net balances in the subsectors were seen in private housing (+27%) and private commercial (+7%). The private industrial sector saw growth for the first time in two years (+14%). The net balances in all other subsectors fell. Public non-housing respondents have not reported growth for over one year (-27%) in Q1 of 2018, while the net balance fell in both the infrastructure sector (-13%) and public housing (-8%)

- Looking ahead, Northern Ireland surveyors remain the least optimistic in the UK. A net balance of 19% of Northern Ireland respondents believe workloads will be higher in 12 months’ time compared to an average of 46% in the rest of the UK.

- Respondents in Northern Ireland were most negative about profit margins for the next 12 months with a balance of (-7%) saying they did not expect their profits to rise.

- Expectations around employment over the next 12 months are among the lowest in the UK at 25%

- Concerns around the shortage of quantity surveyors at +46% of other construction professionals (+20%) are not as high as those in other parts of the UK where there were average respondent rates of (+67%) and (+47%) respectively while concerns over shortages in blue collar workers (+46%) are similar to the UK average (+43%)