Several statutory employment payment rates receive their annual increase in April across the UK, including a record increase to the National Living Wage. Several new employment laws also come into force in Great Britain, which may indicate changes to come in Northern Ireland which employers should start preparing for now.

1. Annual employment rate increases

Several statutory payment rates receive their annual increase in April across the UK, including:

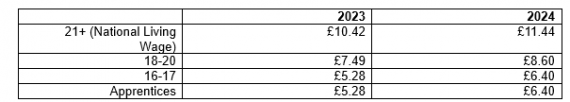

National minimum and living wage (per hour) – from 1 April 2024

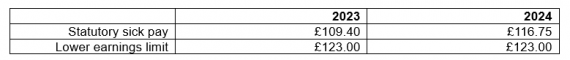

Statutory sick pay (per week)– from 6 April 2024

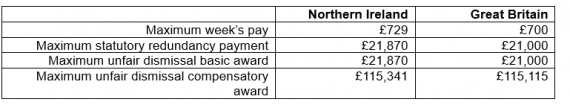

Termination and redundancy – from 6 April 2024

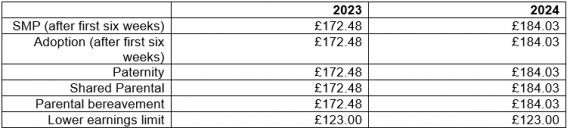

Statutory family-related leave pay (per week) – from 7 April 2024

2. Holiday pay

For holiday years beginning 1 April, holiday pay for irregular hour or part-year workers can be calculated at the end of each pay period using the 12.07% method and can be paid on a rolled up basis.

3. Flexible working

From 6 April, employees will now have a day one right to make a flexible working request to their employer.

4. Carer’s leave

Employees can take up to a week’s unpaid carer’s leave from 6 April.

5. Redundancy for pregnant employees or maternity returners

Priority for suitable alternative employment during redundancies is now extended to pregnant employees and those returning from maternity, adoption or shared parental leave within the last 18 months from 6 April.

6. TUPE transfers

From 1 July, employers can consult with employees directly during TUPE transfers if they have less than 50 employees or the proposed transfer involves less than 10 employees.

What this means for Northern Ireland

We would expect several of these changes to be considered in Northern Ireland with the return of the Assembly. We’ve written about the key employment law developments to look out for at Stormont here.

For further support on these changes, please contact a member of the Tughans Employment team.

While great care has been taken in the preparation of the content of this article, it does not purport to be a comprehensive statement of the relevant law and full professional advice should be taken before any action is taken in reliance on any item covered.